unrealized capital gains tax canada

Unrealized Gains and Losses August 10 2020 Tax Question. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that.

Proposed Tax On Billionaires Raises Question What S Income The New York Times

In Canada 50 of the value of any capital gains are taxable.

. What is the difference between realized vs. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Unrealized gains and losses on foreign exchange.

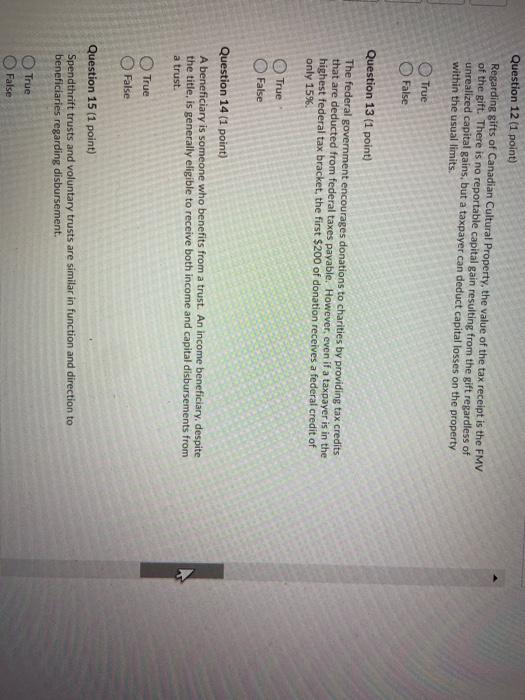

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. 2 Realized capital gains from the sale of primary residences have always been exempt from taxation in Canada. Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the transaction even if you do not have.

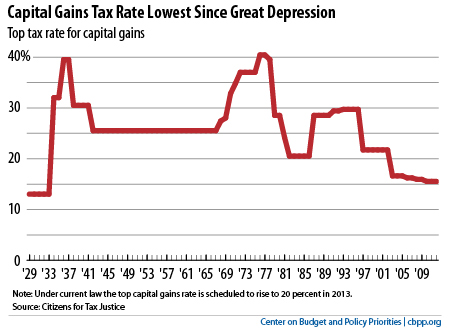

The Problems With an Unrealized Capital Gains Tax. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the 1971 Canadian federal budget. Because of this the actual amount of extra tax you owe will vary according to your earnings and other income sources.

How much tax do you pay on stock gains in Canada. Canadians pay a 50 tax on all of their capital gains. For example if you were ahead of the curve and bought bitcoin for 100.

This means that if you earn 1000 in. For an Ontario resident the combined Federal and Ontario tax rate applicable to a. Since he purchased the BTC back in 2020 for 20K CAD he has now realized a gain of 40000 CAD.

Here is everything you need to know about capital gains tax in Canada so you can stay financially efficient. As the rules are currently written only 50 of a capital gain is subject to tax in Canada. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

In 2022 those rates range from 10 to 37. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of. If you hold an asset for more than one year before you sell for a.

The final dollar amount youll pay will depend on how. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. 3 The 1994 average income of a typical tax filer affected by.

Short-term capital gains are taxed at your ordinary tax rate. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. In Canada only 50 of the capital gain you realize on stocks is taxed the other 50 is yours to keep tax-free.

Unrealized capital gains are. Loans Lines of. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

This gain is something that Bob would have to report on his income tax.

Is There An Unrealized Gains Tax On Cryptocurrency Coinledger

What Are Unrealized Capital Gains Personal Capital

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Capital Gains Tax Canada Explained

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

Taxes At Death Canada Vs The U S Mca Cross Border Advisors Inc

Canada Crypto Tax The Ultimate 2022 Guide Koinly

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

How Taxes On Capital Gains Work In Canada Capital Gains Income 101 Tax Loss Harvesting Youtube

:max_bytes(150000):strip_icc()/TermDefinitions_Capitalgain_finalv1-b039981b63214a4692683b5f10661a01.png)

Capital Gains Definition Rules Taxes And Asset Types

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Analyzing Biden S New American Families Plan Tax Proposal

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Solved Question 12 1 Point Regarding Gifts Of Canadian Chegg Com

The Exit Tax When Moving From The U S To Canada

What Is Unrealized Gain Or Loss And Is It Taxed

Capital Gains Tax Canada 2022 Short Term Long Term Gains Wealthsimple